The Bitcoin (BTC) CRASH Will Resume If the Weekly Trending Candlesticks Close Bearish For The Week

Introduction

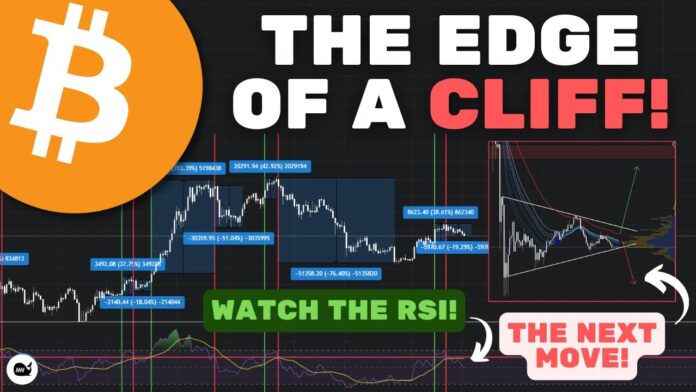

As an avid follower of cryptocurrency markets, I understand the importance of analyzing candlestick patterns to gauge market sentiment and potential price movements. In this blog post, I’ll delve into the significance of weekly trending candlesticks and how they can serve as a key indicator for predicting whether the Bitcoin crash will resume. So let’s dive into the intricacies of candlestick analysis and explore what the weekly candlesticks reveal about the future direction of Bitcoin’s price.

Understanding Candlestick Analysis

Before we delve into the specifics of weekly candlesticks, let’s first establish a foundational understanding of candlestick analysis and its significance in technical analysis.

What are Candlestick Patterns?

Candlestick patterns are graphical representations of price movements over a specific time period. Each candlestick consists of a body and wicks, with the body representing the opening and closing prices and the wicks representing the highest and lowest prices reached during the period.

Significance in Technical Analysis

Candlestick patterns provide valuable insights into market sentiment and potential price trends. Bullish candlestick patterns, characterized by long bullish bodies and short wicks, indicate buying pressure and potential upward momentum. Conversely, bearish candlestick patterns, characterized by long bearish bodies and short wicks, suggest selling pressure and potential downward momentum.

The Importance of Weekly Candlesticks

While daily candlesticks provide insights into short-term price movements, weekly candlesticks offer a broader perspective by capturing price action over a longer time horizon. Weekly candlesticks are especially useful for identifying major trends and potential trend reversals in the market.

Longer Time Horizon

Weekly candlesticks encompass an entire week’s worth of price action, providing a comprehensive view of market trends and dynamics. By analyzing weekly candlesticks, traders can identify significant support and resistance levels, trend lines, and potential reversal patterns with greater clarity.

Confirmation of Trends

Weekly candlesticks help confirm the strength and sustainability of trends identified on shorter timeframes, such as daily or hourly charts. A series of consecutive bullish weekly candlesticks indicates a strong uptrend, while a series of consecutive bearish weekly candlesticks suggests a strong downtrend.

Analyzing Weekly Trending Candlesticks

Now that we understand the importance of weekly candlesticks, let’s explore how they can help predict whether the Bitcoin crash will resume.

Bullish Weekly Candlesticks

Bullish weekly candlesticks, characterized by long bullish bodies and short wicks, indicate buying pressure and potential upward momentum. A bullish weekly candlestick closing above key resistance levels suggests that bullish sentiment is prevailing in the market and that the Bitcoin crash may be coming to an end.

Bearish Weekly Candlesticks

Conversely, bearish weekly candlesticks, characterized by long bearish bodies and short wicks, indicate selling pressure and potential downward momentum. A bearish weekly candlestick closing below key support levels suggests that bearish sentiment is strengthening in the market and that the Bitcoin crash may continue.

Potential Scenarios and Price Targets

Based on the analysis of weekly trending candlesticks, let’s explore potential scenarios and price targets for Bitcoin moving forward.

Bullish Scenario

In a bullish scenario, Bitcoin forms a series of consecutive bullish weekly candlesticks, confirming the strength of the uptrend and signaling a potential reversal of the Bitcoin crash. Key resistance levels to watch include previous highs, with potential upside targets of $50,000 and beyond.

Bearish Scenario

In a bearish scenario, Bitcoin forms a series of consecutive bearish weekly candlesticks, confirming the strength of the downtrend and signaling that the Bitcoin crash may resume. Key support levels to watch include recent lows, with potential downside targets of $30,000 and below.

Risk Management and Trading Strategies

As with any trading or investment opportunity, it’s essential to practice proper risk management and have a clear trading strategy in place.

Set Stop Losses

Setting stop-loss orders can help limit potential losses in the event of a sudden price movement against your position. Determine your risk tolerance and set stop-loss levels accordingly.

Use Proper Position Sizing

Only invest or trade with an amount of capital that you can afford to lose. Proper position sizing ensures that you don’t overexpose yourself to any single trade or investment.

Stay Informed and Adapt

Stay informed about market developments and be prepared to adapt your trading strategy based on new information or changes in market conditions. By staying vigilant and informed, traders can position themselves to capitalize on potential opportunities and mitigate risks in volatile market conditions.

Conclusion

Weekly trending candlesticks play a crucial role in predicting whether the Bitcoin crash will resume or if a reversal is imminent. By analyzing the patterns and formations of weekly candlesticks, traders can gain valuable insights into market sentiment and potential price movements. As we navigate the ups and downs of the cryptocurrency market, it’s essential for traders to stay informed, practice proper risk management, and adapt their strategies accordingly. By doing so, we can navigate the volatility of the market with confidence and resilience, ready to capitalize on potential opportunities as they arise.